Against last minute predictions, UK voters decided in favour of the Brexit. As expected, this sent global equity markets down sharply in the first trading hours of the day.

The final result was 51.9% leave vs. 48.1% remain, with Scotland, Northern Ireland and London strongly backing remaining in the EU, while Wales and England ex-London favored leaving the EU.

Prime minister David Cameron announced his resignation following the results and a successor should be in place by September 2016.

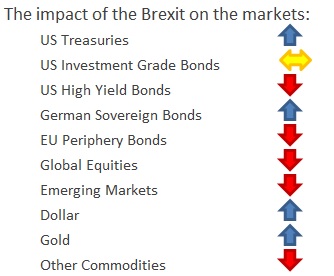

The impact of the vote in the markets

- The British Pound has declined sharply against major currencies, losing 10% against the US Dollar, 8.5% versus the Swiss Franc and 15% against the Japanese Yen.

- Asian equities experienced strong losses as soon as the vote outcome became more clear, with Japan ending the day down 7.92%, Hong Kong -3.65% and Australia -3.17%.

- European equities opened with steep losses across the board, the financial sector leading the way with losses of 20%+ in both UK and European banks.

- The Eurostoxx50 is currently down 8.8%, Germany is down 7.0%, France is down 8.5%, Spain is down 11.1% and the UK is losing 4.9%.

- Sovereign bonds and Gold are the main winners of the day. The 10 year US Treasury yield fell to 1.52% (from 1.75%) and the 10 year German Bund yield fell to -0.08% (down from +0.10%), whilst Gold climbed 5% to $1’313.77, the highest level since 2014.

- Oil is down 4%, with the WTI priced at $48.2 in New York.

We expect volatility and market swings to remain strong for risky assets as investors try to price both the economic and political implications of the UK leave vote in the whole region.

We anticipate a rise in nationalism across Europe, with Euro-hostile movements gaining traction in countries like the Netherlands and France. That is likely to lead to higher credit spreads in the periphery bonds, increasing borrowing costs of countries like Italy, Spain and Portugal.

The ECB, together with the Bank of England and the FED are likely to coordinate actions to counterbalance the market volatility, but their effectiveness will depend as much on their rhetoric as on their actions, as investors will be looking to them for guidance and leadership.

It is important to note that the Brexit vote is the beginning of a two-year negotiation process with the EU that will end with the UK’s expulsion from the union. There is uncertainty over whether the UK will suffer some form of retaliation when discussing its future status within the EU, or if the country will seek a Switzerland-like relationship with the bloc that will allow it to access the European Single Market.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com