Market commentary & outlook | May 2016

May proved to be another volatile month, with similar market fluctuations to what we witnessed in April, the result of which was another good month for most global risk assets. The equity indexes of developed markets ended the month up, while high yield bonds climbed once again - pushed by oil’s gains.

Once again, the FED was the main influencer of the month. The release of the minutes from April’s meeting pointed to a higher than anticipated risk of a U.S. interest rate hike in June. As a result, the U.S. Treasury yield curve adjusted to the expectation of a hawkish FED, thereby bringing down the value of both sovereign and investment grade bonds. Later in the month, Chairwoman Janet Yellen reiterated that the time for an interest rate increase is near. However, she once again raised concerns that if rates rise too quickly, the central bank will have very limited tools to fight a severe economic or financial downturn and for this reason, intends to proceed slowly. That was just the message investors were looking for and the markets ended the month on a positive note, despite some mid-month losses.

Another strong month for risk assets:

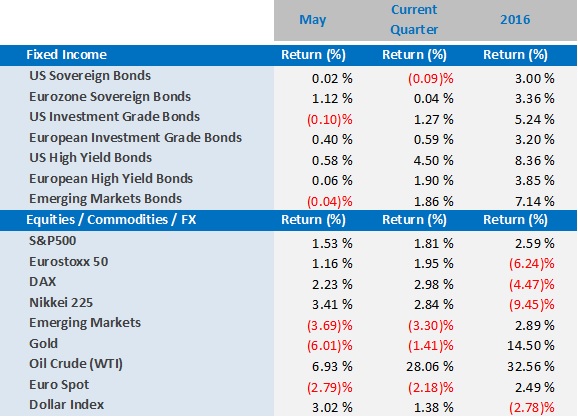

- The U.S. Dollar regained part of its losses in 2016 so far, gaining 3.02% in the month - the counter effect of which was the drop in most commodity prices.

- Emerging markets had a negative month, with both equities (-3.69%) and bonds (-0.04%) losing in response to the strong U.S. Dollar.

- Oil managed to reach USD 50.00 per barrel during the month, before the WTI lost steam and finished at $49.10, despite the strengthening dollar. Crude reached its lowest daily production level in the U.S. since 2014. This, coupled with disruptions in Nigeria, Libya and Canada closed the gap between supply and demand and supported the gains in the month.

- Developed markets equities had a positive month, led by positive European news: Greece’s creditors reached an agreement over a new debt relief package and Brexit polls in the U.K. pointed to the victory of the pro-EU vote in June’s referendum.

- US equities ended the month up 1.5%, European equities rose 1.75% and Japanese stocks climbed 3.41%.

- Fixed income markets had mixed results, once investors digested the news coming from the FED and its board members: U.S. Treasuries ended the month flat (up 0.02%), while investment grade bonds lost 0.10% and high yield bonds gained 0.58% - supported by the gains in the oil price.

Global markets in numbers

Market Outlook and V3´s position

With equity valuations approaching extreme highs, it is somewhat counterintuitive to see the market reaching for fresh 2016 highs in the U.S., especially as there is a risk of an imminent interest rate increase that could strengthen the U.S. Dollar and further damage U.S. companies’ margins.

June will see more than its fair share of important events, each of which have the potential to heavily influence the various markets and asset classes:

- Meeting of the ECB, FED and Bank of Japan monetary policy committees, which may bring a lot of volatility to the markets;

- A long-awaited OPEC meeting that will try to reach an agreement between its members after the failed April Doha summit;

- The result of the Brexit vote, which could have political and economic implications, not only for the UK and Europe, but also for the rest of the world, as it may initiate the fall of the Euro and the Eurozone breaking up;

- June is known for being a weak month for markets historically – in the past 10 years it has been one of the worst months of the year for U.S. equities, supporting the infamous “sell in May and go away” adage.

As the threat of a more volatile market environment increases, we remain committed to our stance not to add risk to the portfolios for now. We appreciate that a change of heart by the FED would stop interest rate hikes in the coming policy meetings and greatly affect investor sentiment – for better or worse – but we believe that the upside of either scenario pales in comparison to the risks that the current market valuations already display. Because of that, we will continue to focus on liquid strategies based on a broad global diversification, favouring flexible, actively managed strategies and more than ever seeking to allocate in quality names across all asset classes, be it in equities or fixed income investment grade, high yield or emerging market bonds.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com