General market comments | April 2016

April was another good month for risk assets worldwide. Global equities continued to rally despite increased volatility. The US Dollar weakened yet again, pushing commodity prices up and credit spreads down in a month of little movement in the US interest rate curve.

Both the ECB and the FED held meetings during the month, however there were no changes to interest rates in either regions. The FED indicated that it was in no rush to raise rates in its next meeting in June. Meanwhile the ECB hinted that they would move even more cautiously, suggesting that rates would remain at current levels or lower for an extended period and that additional easing measures (including further adjustments to its bond purchase programme) would be implemented, if necessary.

Another strong month for risk assets:

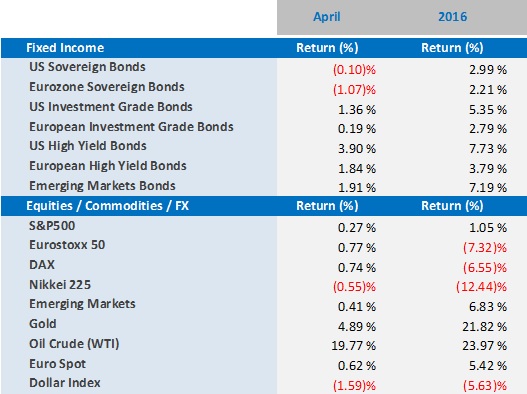

- Once again, the US Dollar edged lower, losing 1.6% in the month – as a result, it was another strong month for commodities and emerging markets (both equities and fixed income).

- Oil had another month of impressive gains, ending April up 19.8% and closing above $45 per barrel for the first time since February. This was mainly in response to the weaker US Dollar and despite the somewhat expected inability of several major oil-producing countries to reach an agreement to cap global production.

- Gold gained 4.9% in April, due to a weaker US Dollar and increased volatility. This performance has meant that the commodity was able to recover March’s losses and has managed to gain 21.8% so far this year.

- After March’s incredible results, Emerging markets equities had mixed results in April, with gains in Brazil and Russian counterbalanced by negative results in China. As a whole, the sector finished the month up 0.4%.

- US equities finished the month slightly up, with the S&P500 gaining 0.3%. The FED’s delay in raising interest rates and the trend for the US Dollar to weaken are blessings for those US companies that generate a percentage of their revenues overseas.

- European equities followed the developed market trend, ending the month up 0.8%. The periphery countries formed the highlights of the month, with the Spanish market up 3.5% and the Italian market up 2.7%.

- Fixed income markets once again took advantage of the positive environment created by the central banks and their accommodative, or at least not tight, monetary policies. Sovereign bonds in the US and Europe suffered in response to the risk-on sentiment and the low yield environment, while credit markets had another strong month.

- US high yield bonds reaped an impressive 3.9% gain in April (up 7.7% in 2016 alone), as the recovery in commodity prices had a positive knock-on effect on the energy and materials sectors in the month. European high yield bonds also had a strong month, up 1.8% in April (+3.8% in 2016), while Emerging market bonds performed similarly, finishing the month up 1.9% (+7.2% in 2016), as gains in commodities and the weak US dollar helped to support this sector as well.

Global markets in numbers

Market Outlook and V3´s position

Sell in May and go away? The idea that investors should sell in May and return to the markets in October seems very appealing if you look at historical data since the 1950’s of the Dow Jones Industrial Average. Gaining up to 4% on average in the first four months of the year, the index returned close to 0% in the following six months, only to gain a further 3% in the last two months of the year. Nevertheless, averages do hide a lot of diversity within and we need to give more importance to fundamentals and momentum than to history, when deciding the best investment strategy.

The risk of a Brexit and the fact that the equity market is close to being considered overvalued only add to existing uncertainties and will keep volatility levels high in the coming months. However, since monetary policies are still accommodative in most of the developed world and this stance should not change any time soon, markets should feel supported by cheap and easy money that will continue to flow abundantly. The recent recovery of commodity prices, coupled with better than expected macroeconomic data from China have boosted confidence around the globe and eased the pressure in weaker economies, leading to a decline in the systemic risk.

We remain committed to our neutral stance on risk and will not add to the portfolios for now. The current market valuation and the risk of contamination, should a Brexit occur in late June, may make recent price corrections seem like a little hiccup and we need to be ready to act in case this worst-case scenario materialises. Therefore, we continue to focus on liquid strategies based on a broad global diversification. We still favour flexible, actively managed strategies and more than ever seek allocations in quality names in all asset classes, be those in equities or fixed income investment grade, high yield or emerging market bonds.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com