General market comments | November 2015

The stage has been set for an end of year rally. October’s strong gains extended into November in the developed world’s stock market, despite multiple attacks and threats to global security. Whilst this is in line with the season’s optimistic tendencies, this positive market momentum may be curbed by increasingly divergent monetary policies from major central banks, as well as the impact of global terrorist attacks and consumers’ and investors’ reactions to security threats.

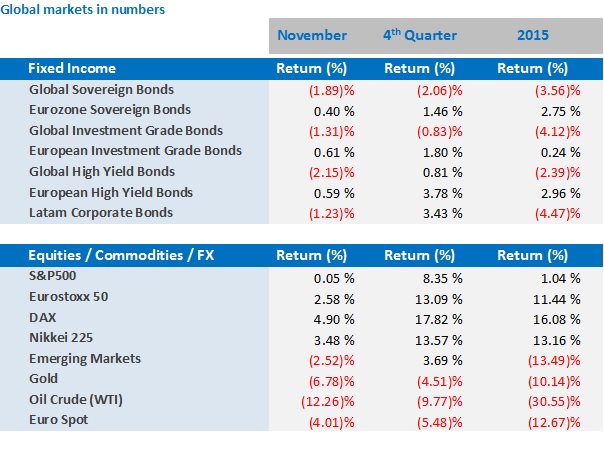

Mixed results for global equities:

- Strong gains in Europe, stability in the US, and losses in emerging markets - as commodities once again under performed.

- In the fixed income market, not surprisingly, US bonds under performed their European counterparts as markets increasingly priced in a December interest rate hike in the US.

- European assets were supported by the expectation that the ECB would expand their monetary stimulus measures, pushing yields lower across the board.

Market Outlook and V3´s position

The last quarter of the year has so far fulfilled its promise to be a merry one and perform positively. Although momentum did fade away significantly from the spectacular gains seen in October to the mixed returns in November, it is still too soon to predict a change of heart in the investor sentiment and any sort of reversal in recent market gains.

Future volatility may send the markets down and put an end to the positive run and seasonal good will we have seen in the past two months. The main areas to watch and prepare for are:

- Increased uncertainty, as a result of the recent terror attacks in France and the heightened number of failed plots all around Europe can potentially halt recent market gains and, as such, reverse the fortune of investors around the globe.

- An increase in interest rates in the US in December, followed by a hawkish message from the Fed.

- A weaker than expected expansion of the Quantitative Easing programme by the ECB in Europe.

Diversification and liquidity should be on every investor’s mind and prudence needs to be part of any investment approach. We continue to favour flexible and actively managed strategies, and prefer quality names in investment grade, high yield and emerging market bonds over broad index allocations.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on

+41 22 715 0910

cassio.valdujo@v3cap.com