General market comments | January

It was a brutal month for risky assets. Renewed concerns over global economic growth resulted in some of the worst losses ever recorded in global equities for the month of January. Some of the main causes included:

- Both the World Bank and the IMF downgrading their global macro projections for 2016.

- Uncertainties regarding the true state of China’s economy.

- An unstoppable decline in commodity prices.

Once again central banks came to the markets´ rescue, with the Bank of Japan being the latest to join the NIRP (negative interest rate policy) club and the ECB hinting at further stimulus. The US was no different with the latest weak economic data increasing the probability that the Fed will hike interest rates only once in 2016.

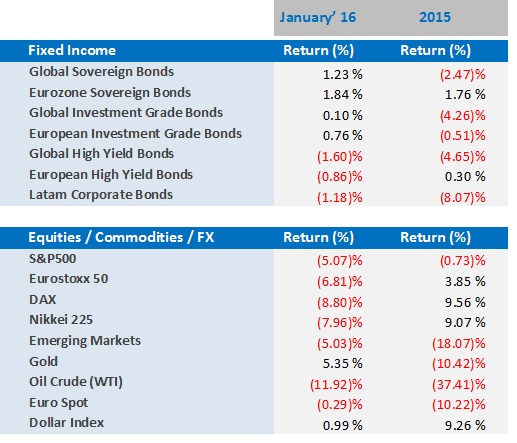

A bloodbath for risk assets:

- Losses across the board for both fixed income and equity markets, with global sovereign and investment grade bonds being the only bright spots.

- 2016 started on a very negative note for Chinese equities, which lost over 20% in January, after a disastrous 2015. Markets were closed twice in the first trading week of the year, as investors sold assets in panic after the market reached its now defunct circuit breaker level.

- US equities had the worst-ever start of the year with repeated waves of selling in the first days of January as investors feared spill-over effects from the Chinese market’s meltdown.

- European equities followed the negative sentiment in the market, reaching losses of -12% and above before being rescued by the ECB and its promise of “further stimulus”.

- Oil reached its lowest level in more than 12 years on the 20th of January, after which it experienced an impressive rally due to hopes of a coordinated effort amongst producers to limit supply – proving enough to offset part of the losses in the month.

- High yield spreads remained closely correlated with commodities, staging another month of strong losses for bonds as investors tried to stay away from riskier assets.

Global markets in numbers

Market Outlook and V3´s position

For those believing in the ´January effect´, the hypothesis that prices increase in January more than in any other month of the year, the market performance was certainly dispiriting. The extreme market volatility in most asset classes (e.g. 10 out of 19 trading days in January recorded moves bigger than 3% in oil prices), together with the persistent negative investor sentiment, could only result in more short-term pain. Having said that, we find that there is still not enough evidence to suggest that the worst-case scenario of a global recession and/or a 2008-like financial crisis is likely.

One thing is certain, volatility is not going anywhere in 2016 and the reasons are many:

- The year so far has been dominated by a heightened level of negative sentiment toward global economic growth.

- In Europe, the ECB is expected to announce further stimulus at the end of Q1, which could keep supporting the markets in the short-term. However, the failure to fulfil investors’ expectations could trigger another wave of selling.

- The US economy is expected to grow only moderately, that coupled with the recent weakening of the job market had investors pricing a single +0.25% rate hike in 2016, which could result in a weaker dollar. On the other hand, recession fears are ever more present and some analysts’ extreme scenarios point to negative economic growth already in 2016.

- Fixed income illiquidity remains a real concern, as the lack of market-makers with sizeable inventory books mean that any bond sale must be met by an investor willing to take on the risk.

- Concerns about China’s growth and strong capital outflows remain elevated.

- Ongoing selling by sovereign wealth funds is set to persist in this particularly weak market environment, which, in the absence of a change in the economic outlook, will limit any strong upside.

- Oil prices are bound to stay under pressure in 2016, as the possibility of a coordination between OPEC, Russia and Mexico (amongst others) to cut the oversupply of the commodity is weak, to say the least.

Once again, the key to successfully navigating such choppy waters is diversification. Each asset class reacts differently to external shocks. Investors are turning to safer alternatives to park the proceeds of their fire-sales, such as an allocation in high grade bonds, which although potentially generating close to zero interest, could be used as a hedge in case of an equity market selloff.

A recessionary environment would require a completely different allocation than that of positive economic growth. Therefore, it is important to be ready to react and to make sure portfolios can survive a variety of scenarios. As such, we continue to favour liquid alternatives to illiquid ones, as well as flexible and actively managed strategies versus passive benchmark allocations. Quality is still the name of the game and can mean the difference between a close call and a lost battle.

We appreciate that the current market environment requires investors to be cautious. Nevertheless, in the absence of any meaningful change in the global economic outlook and taking into account the current low interest rate scenario, we believe that a diversified portfolio is the best option to take advantage of any investment opportunities that might arise from the increased volatility in the markets, while limiting the losses in any adverse situation.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com