General market comments | February 2016

After a terrible start to the year financial markets somewhat stabilised in February, ending the month in better shape than they started. Global equities recovered part of the losses incurred earlier in the month with U.S. equities once again performing better than their European counterparts. The improved sentiment seen towards equities in the second half of the month spilled over to the credit markets, and both investment grade and high yield bonds returned positive results after credit spreads reached their widest point since 2009 on 11th of February, 2016.

Central banks were once again in the spotlight, with the Federal Reserve releasing the minutes of January’s meeting, showing that an interest rate hike in the U.S. would be unlikely in the near-term. The Bank of Japan’s implementation of the NIRP (negative interest rate policy) was not without turbulence, and the BoJ stressed that there were no limits to easing measures. In China, the People’s Bank of China cut the reserve requirements for leading banks by 50 basis points, in a move that was aimed at supporting economic growth by increasing the amount of money in circulation.

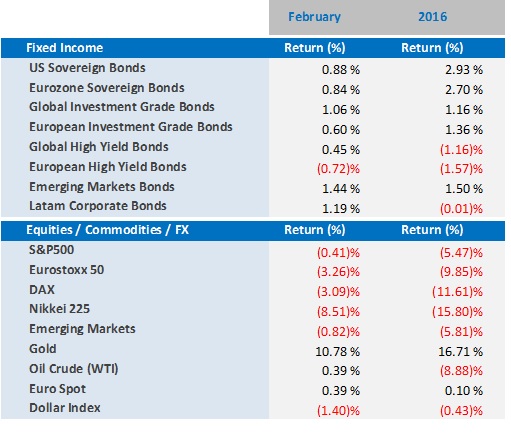

A very volatile month in the markets:

- European equities ended the month down around 3%, after losing as much as 10% in the first 10 days of February.

- U.S. equities only lost 0.4% in the month mainly due to a mid-month rally resulting from the release of the minutes from the Federal Reserve’s January monetary policy meeting, which pointed to fewer interest rate increases than previously expected.

- Japanese equities lost 8.5% which was an unexpected consequence of the BoJ’s announcement that there would be no limit to the easing measures they would implement, which came after placing interest rates in negative territory in late January. As a result, the Yen was seen as a safe haven by investors and appreciated sharply in the month (+7.5%). This had a knock-on effect on equities, which were pushed down as investors pulled out of the market.

- Emerging markets had a surprisingly improved performance, ending the month down only 0.8%, as commodity prices recovered in the second half of the month. Highlights came from Latin American markets, with the Brazilian Ibovespa up 5.9% and the Argentina’s Merval up 16%.

- Fixed income markets ended the month with gains in most sectors, with the exception of European high yield bonds, which were punished by their heavy exposure to subordinated bank debt which suffered the most in the month.

- Investment grade bonds gained 1.1% and high yield bonds returned 0.5% despite dismal returns on bank bonds, which were down between 1.5% (senior debt) and 10% (subordinated and hybrid bonds).

- Oil staged a strong comeback after reaching its lowest level in 12 years on the 11th February, 2016. This turnaround came after Saudi Arabia and Russia (as well as minor producers) agreed to freeze oil production at the level of the end of January. The commodity jumped +30% in the 2 weeks that followed, finishing the month up 0.4%.

- Gold was once again the best performer of the month, continuing its strong performance in January and reaping a 10.8% gain in the month - now up 16.7% in 2016. The commodity has been the safe haven of choice in 2016 so far and has enjoyed its best start to the year since the 1980’s.

Global markets in numbers

Market Outlook and V3´s position

After the impressive mid-month rally in risky assets, we expect markets to return to their usual volatile state as uncertainties weigh on investor sentiment. Once again central banks will take centre stage, as decisions by the Federal Reserve in the U.S. and the ECB in Europe could be the catalysts for strong price moves across the markets. In the future, Bond prices should be supported by the ECB’s expected unveiling of new monetary policy easing measures and because the Federal Reserve should keep interest rates unchanged. However, the devil is in the detail and there is the potential for a lot to go wrong. We have seen that actions taken by the ECB have been in conflict with the messages given. After weeks of promising further stimulus, the ECB runs the risk of falling short of investors’ expectations and inducing a market selloff. Even if new measures are announced, markets could react very badly - the 5% intraday losses of the Eurostoxx50 of the 3rd of December of 2015 are a vivid reminder of this possibility.

We remain optimistic that global economic growth will not fade into a global recession any time soon. U.S. growth should remain in positive territory, preventing any market sell-off from becoming more than a short term market correction, as well as supporting credit markets, both investment grade as well as quality high yield bonds. In Europe, despite the risk of under delivering on its monetary policy, the ECB will keep its easing stance, which is positive for both equities and credit.

We still believe that a diversified and liquid investment strategy is the best way to navigate in such volatile times, as it is important to be ready to adapt to new market realities as they come. As a result, we keep favouring quality names in equities and in investment grade, high yield and emerging market bonds as well as flexible and actively managed investments versus a passive allocation in broad indexes where possible.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com