General market comments | December

December was, by any account, a very eventful month with the year ending as it began, with Central banks in the spotlight, with the Fed increasing interest rates for the first time since 2006, ending 7 years of close-to-zero interest rates in the United States. In Europe, the ECB decided to extend its EUR 60 billion a month bond-buying programme to at least March 2017 (from September 2016), as deflation risks persist in the region and economic growth remains limited.

Negative results for risk assets:

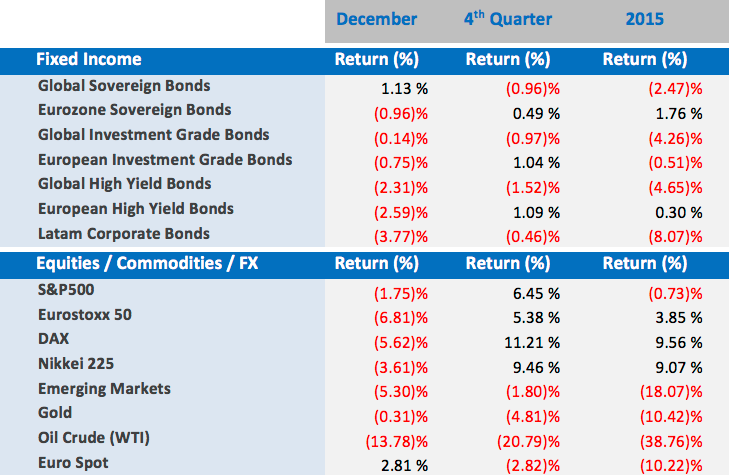

- Losses across the board for both fixed income and equity markets, with global sovereign bonds being the bright spot, outperforming most asset classes.

- Strong losses in global high yield bonds, as the interest rate increase in the US prompted investors to flee the asset class and sell riskier positions, hoarding cash as the year ended.

- A disastrous month for European equities, as investors reacted negatively to the expansion of the ECB’s QE programme, which most investors saw as weaker than expected. Ironically, in the same period, the fragile economies of Spain and Italy finally reported some good news with industrial production numbers showing growth above expectation.

- In the US, the aftermath of the FED interest rate increase was not as bad as some predicted, but bad enough to send the S&P negative for 2015.

- Emerging markets had another bad month, with Brazil plunging even deeper into recession as the long-lasting corruption scandal has guaranteed a political paralysis, all of which has culminated in its sovereign rating being downgraded to ‘junk' status.

- Oil reached multi-year record low prices in December, trading at levels last seen in 2008 in the heights of the financial crisis.

Global markets in numbers

Market Outlook and V3´s position

Contrary to our expectation, December ended the year on a negative note, with investors trimming exposure to risky assets and shedding everything from investment grade bonds to emerging market equities. Despite the bleak picture, we still believe that global economic growth in 2016 will surpass that of 2015, with low inflation and energy costs supporting consumption growth in the developed world.

In the markets, volatility is here to stay and 2016 will be no different from 2015 in this respect, with uncertainties on all fronts:

- The Fed increased interest rates for the first time since 2006 in December of 2015 and is expected to continue to raise them at every subsequent policy meeting in 2016. Nevertheless, these raises will be data dependent, which could result in a more aggressive cycle than currently priced.

- The ECB is expected to keep reassuring investors that it is pursuing the right policy and using the appropriate tools to do that, despite this we expect the markets to remain sceptical of the results.

- The ongoing commodities rout is likely to remain strong in 2016, putting pressure on emerging markets and the energy and materials sectors in the near-term.

- Chinese economic activity is likely to keep weakening in 2016, prompting the yuan to devalue and reach fresh new lows. This will bring increased volatility to the markets, similar to those seen during the selloff in August/September of 2015.

- A potential geopolitical event in the Middle East, possibly involving Russia and NATO, would bring considerable selling pressure to the markets and could affect consumer confidence across the globe.

Diversification, not only in asset classes but also across different economies and monetary regimes, will be vital in the future. Changing demographics, economic realities, high levels of debt and increasing concentration of wealth will add to the already full list of aspects to consider when investing in any market.

Investors should not assume that in an increasingly political world, every nation will do whatever it can to keep exchange rates stable, service its debt or even to play by the consensual rules, when it comes to support its own economy. In this environment, it is ever more important to keep liquidity at elevated levels and be prudent when deciding on an investment strategy.

We favour flexible and actively managed strategies versus passive allocations, and still like quality names in investment grade, high yield and emerging market bonds over broad index allocations.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on

+41 22 715 0910

cassio.valdujo@v3cap.com