General market commentary | March 2016

Investors took full advantage of the better sentiment seen in March and markets across the globe snapped back sharply, posting gains in all major asset classes. The main exception was Gold, which behaved as expected in a risk-on environment and ended the month with losses, albeit smaller than one would imagine in such a strong market.

Inspired by a dovish FED, US interest rates edged lower in the month, supporting a relief rally in the whole fixed income spectrum. This also sent the US Dollar sharply down, which helped push commodities and emerging markets up - with both posting impressive gains in March. Global equities also performed well, with the S&P500 and emerging market equities back in positive territory so far this year.

In Europe, the ECB delivered on its promise of a more accommodative and expansionary monetary policy, lowering the deposit rate by 10 basis point to minus 0.40%, and increasing the monthly purchase amount of bonds by EUR 20 billion, to EUR 80 billion, while adding corporate bonds to the list of eligible assets.

Although investors welcomed the fact that the FED played ball with the markets (aligning its own expectations with those of the market after adjusting its views on interest rate increases from four to only two hikes in 2016), the fact that markets rely so much on central banks cannot go unnoticed. The dependence on cheap money and the never ending “low for longer” narrative can end in a big mess that will either make central bankers famous or infamous. Corporations, as well as individuals, need to take advantage of the low interest rates to optimise their balance sheets, not to create time-bombs ready to explode as soon as the low interest rate bonanza ends.

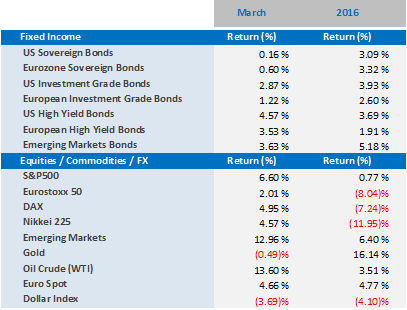

A very positive month in the markets:

- U.S. equities had a great month, fuelled by Janet Yellen’s testimony that the FED would proceed with caution and planned to increase interest rates gradually. The S&P500 ended the month up 6.6%, and is back to positive territory in 2016.

- As a result of the ECB’s actions, European equities also had a good month. Although performance in local currency was not as impressive as that of their US peers (as the DAX ended March up “only” 4.95%), it jumped an incredible 9.83% in US Dollar terms.

- Emerging market equities had their best results since October of 2011, gaining 12.96% as a result of the winning combination of a weaker dollar and strong commodities prices. The Brazilian Ibovespa jumped 16.97% in the month (30.32% in US Dollar terms), as investors responded positively to the increasingly likely impeachment of president Rousseff.

- Fixed income markets took full advantage of the positive environment created by the FED in the US and the increasingly accommodative policies in Japan and Europe, ending the month with strong gains.

- US high yield bonds returned an impressive 4.57%, aided by both lower interest rates in US Dollars and the positive sentiment amongst investors. US investment grade bonds were similarly affected, posting a 2.87% gain in the same period. European bonds also performed well helped by the ECB’s actions, while emerging market bonds jumped +3.63%, as investors took advantage of the previously depressed prices to build positions in the asset class.

- Oil was once again one of the highlights of the month, with the WTI ending the period up 13.60%, as investors digested news that the Organization of the Petroleum Exporting Countries (OPEC) and other non-member countries would gather to discuss further actions to support oil prices in the near future.

- In this risk-on environment, gold was one of the biggest losers. After an impressive run in the first two months of the year the metal was priced at $1’232 in March- down 0.49%.

Global markets in numbers

Market Outlook and V3´s position

March was a very positive month for the markets in general, but we cannot fail to notice that once again, it was motivated by central banks’ actions. The markets’ failure to climb higher based solely on fundamentals, instead of cheap money, is worrisome. Nevertheless, it is important to reiterate our expectation that central banks will keep supporting the markets for the foreseeable future.

- The European Central Bank and the Bank of Japan are engaged in a long-term battle against low inflation and low growth, and should keep reassuring investors that they can and will do more, if needed, in order to reach their objectives.

- In China, the People’s Bank of China is stepping away from the currency market, terminating a clear source of uncertainty to investors, as Beijing now seems to be aiming at larger fiscal deficits to spur growth instead of a weaker yuan.

- Finally, in the US, the Federal Reserve appears to have adopted a more dovish stance, despite an improved domestic economy, suggesting that it perceives the danger of being too early to normalise rates greater than that of being too late.

As we have stated before, the market’s addiction to cheap money and its dependence on it are some of the biggest concerns we have, as the likely abstinence crisis on the way back to a normalised interest rate environment can, and most likely will, bring increased volatility and price corrections.

We remain committed to our views and are not expecting to make a major change in our recommendations anytime soon, as we believe that focusing on liquid strategies based on a broad global diversification in the best way to withstand these volatile and fast-changing markets. We continue to favour flexible actively managed strategies, as well as allocations in quality names in all asset classes, be it in equities or fixed income investment grade, high yield or emerging market bonds.

For more information, please contact our Investment Specialist, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com