Market insights

Welcome to a new era! How many times have we heard this phrase, with much fanfare, only to realize that nothing really changes after all? Whether it is the 5G revolution coming to a telephone or smart-car near you, or the incredible ‘quantum supremacy’ allegedly reached by Google (that seemingly has the potential to change the way we use computers and solve problems), we are surrounded by situations that claim to be the start of something that will change the way we live forever.

Of course, 5G technology will transform the way do things, be it via super-fast data transfer speeds to download a movie on our mobile devices, or to allow for self-driven cars to move around safely. The problem starts when we begin to expect life to change instantly after such disruptive discoveries happen. In reality, the majority of these new technologies depend on a massive and tedious infrastructure build-up, such as antennas for the 5G network, fast-charging stations for electric cars and even refining the process to mass-produce the parts needed.

There is no doubt that headlines, such as ‘quantum supremacy’, look cool and lead us to believe that we will be surrounded by robots and AI in a Blade Runner type of reality. Undoubtedly, this is much more interesting that imagining some very smart people in a room, huddled around a screen, waiting to see if a computer was able to execute a specific, complex task. We have great expectations about the future: flying cars, fighting robots and colonising Mars - to mention a few of the most popular. The risk is that we become disappointed with the incremental changes that these discoveries bring to our lives, and in some cases do not even perceive them happening at all. But do not worry: change is going to happen and it will certainly have a big impact in the way we will live our lives in the future.

Incremental changes were certainly in vogue in October in the markets and elsewhere. Major events and breakthroughs were mostly absent, however steps have begun to be implemented towards achieving the newly announced potential intermediary deal between the US and China regarding their trading dispute. This brought new blood into the markets, which kept the positive momentum of the previous month going.

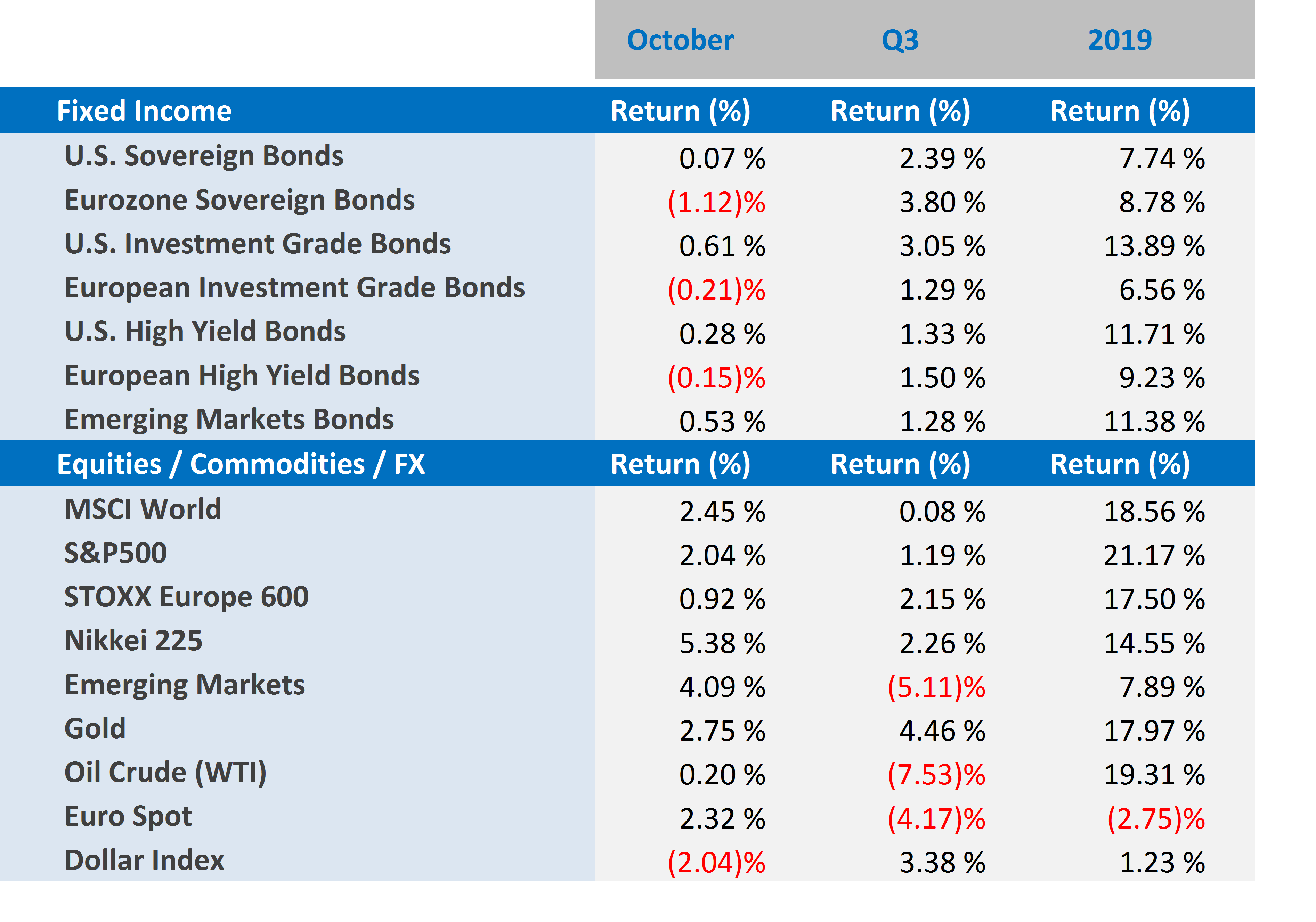

- Developed market equities had yet another positive month, fuelled by hopes of a US-China trade deal, positive corporate results and another interest rate cut in the US by the Federal Reserve. The S&P500 gained 2.04% in the United States, the STOXX Europe 600 gained 0.92% and in Japan, the Nikkei 225 gained 5.38%.

- Fixed income markets had a mixed month, as interest rate cuts in the US fuelled dollar denominated holdings, while European bonds were negatively affected by the stronger than expected economic growth figures for Q3 and a risk-on sentiment by investors. US Treasuries gained 0.07%, US investment grade bonds gained 0.61% and US high yield bonds ended the month up 0.28%. In Europe, sovereign bonds lost 1.12%, investment grade bonds lost 0.21% and European high yield bonds lost 0.15%.

- Emerging markets had a positive month despite major tension building in Latin America and the ongoing conflict in Hong Kong. Gains in bonds were fuelled by lower interest rates in the US, while equities were pushed by the weaker dollar and the prospect of an agreement between the US and China in the coming weeks. EM equities gained 4.09%, while EM bonds gained 0.53%.

- Oil prices had a somewhat positive month, gaining 0.20% as better prospects for global economic growth supported commodity prices.

- Gold gained 2.75%, recovering part of September’s losses - this positive momentum remained alive, with the weaker US Dollar supporting prices. As the US hits pause on its interest rate cut cycle, investors should soon start to ask themselves whether this means that inflation expectations will begin to rise, increasing the demand for the yellow metal as the natural hedge against inflation.

Global markets in numbers

Market Outlook and V3´s position

Doing even a brief search into the prospect of quantum-computing gives you an idea as to why all major powers are going after this technology: the potential to crack unbreakable encryption in a matter of minutes (or inversely to safeguard data against anyone and anything), to understanding and finding solutions for global warming, to curing diseases or even to exploring space. Google’s quantum computer reached ‘quantum supremacy’ by, for the first time ever, being able to perform a computational task that would be essentially impossible for a conventional computer to complete. This was lauded as a major achievement by specialists, apart from IBM, which has been working on its own quantum computer for a while and, understandably, downplayed Google’s results. But what does this mean for us mere mortals? The dramatic headlines feed unwarranted and unrealistic expectations of what the near-term implications are going to be, when realistically changes will be non-existent in the short term. However, we must not forget that every technological revolution started somewhere and was probably ignored by most until it was too late, disrupting the way we lived until then. Anyone still holding on to an old Nokia phone?

Shifting from technological issues to more real-life situations, it is easy to find circumstances in which we find ourselves dealing with the same conflict between the theoretical long-term and the practical short-term impact of a novelty. Looking at what is happening in the markets right now, there are numerous examples of this conflict and the impact it has on prices. One that always comes to mind is China’s rise in influence and its conflict with the US in the economy, trade, technology, military and soft power, to name a few.

From America’s perspective, the rise of China is a disruption event, potentially even catastrophic, depending on who is doing the analysis. It is easy to find opinion pieces saying that either the US blocks China’s growing global influence or we will all need to be ready for a Chinese-centric world in the near future. The reality is much more complex than that, obviously. It is very hard to imagine any scenario that would show China having the same level of influence that the US has had globally since the end of the Second World War, or even the Cold War in the 1980’s.

How do we prepare for such potential disruption? That is a question worth asking, though the answer, as in the case of quantum computing, is rather undramatic. Why? Because the changes are so gradual and intangible that any attempt to anticipate them, by shifting one’s whole portfolio from US to Chinese stocks, for example, could backfire spectacularly depending on the timing of such a shift. Nevertheless, we must not ignore the incoming changes and simply keep doing things the way we always did ‘just because they work’.

As a result, we believe that investment portfolios should show a decent geographic diversification, but also invest in long-term trends, to take advantage of the gradual changes in our lives and in technology. We believe the best way to approach portfolio management, for now, is to couple this with dynamic risk management to trim any excess exposure in times of uncertainty and hedge against potential tail risks. We are keeping our hedges in place, whilst remaining committed to the potential market upside, even if prices seem to be rising above reasonable levels thanks to the support of central banks and the prospect of an intermediary deal between the US and China. As always, we are left asking ourselves the unanswerable question: where will the next disruption come from?

For more information, please contact our Chief Investment Officer, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com

Cover image: https://www.shutterstock.com/image-illustration/3d-rendering-robot-learning-solving-problems-680929729