Market insights

Who does not remember getting excited to see a blockbuster after watching its trailer? Those carefully chosen scenes and dialogs give spectators just enough clues to spark their curiosity, without giving away too much so as to cannibalise interest in the whole movie. I am a sucker for a good trailer, but they can leave me open to huge disappointment when the movie does not live up to expectation.

If life is a movie, then August was the trailer every blockbuster wanted to have released! There was drama, action, multi-layered characters interacting in a complex storyline and no clear sign of how it would end. It had all the elements of a critically acclaimed movie and box-office phenomena. Don’t take my word for it, just look at what happened and decide for yourself: In the US, Trump went from an all-out-trade-war on China (including ‘ordering’ US companies to source their goods away from China) to being open to dialogue with his ‘antagonists’, while uncharacteristically touting how much of a great leader the Chinese president is (talk about a plot twist!). At the G7 meeting in France, Trump once again stunned US political commentators by saying that Russia should re-join the group (after being kicked out in 2014 over the Crimea annexation), despite their alleged interference in elections from the US to Europe.

Still in the US, the interest rate curve inverted during the month (the yield on the longer 10-year note was lower than the shorter 2-year note, which is not a natural occurrence). Investors started to panic, as curve inversions are a classic signal of a looming recession, having occurred before each US recession in the past 50 years, while offering only one false signal in that time. Not enough drama? Well, this trailer isn’t over yet and finishes with a finale, including Trump tweeting that his own Fed Chairman pick and the Fed’s monetary policy committee is to blame for all the economic ailments the country is suffering. Elsewhere in the world, despite massive support from the IMF already in place, Argentina declared a selective default (not again?!) on its short-term bonds while gifting investors a ‘voluntary reprofiling’ of $50bn of longer-dated debt, mostly owned by foreign investors. The cherry on the cake was that this was followed by the implementation of capital controls in the country at the turn of the month. Like a World Cup match table, the list could go on and on: Japan vs Korea, India vs Pakistan and even the Amazon forest crisis (vs the world?) - which could heavily affect Brazilian exports and put even more pressure in this already battered economy. I think you got the idea.

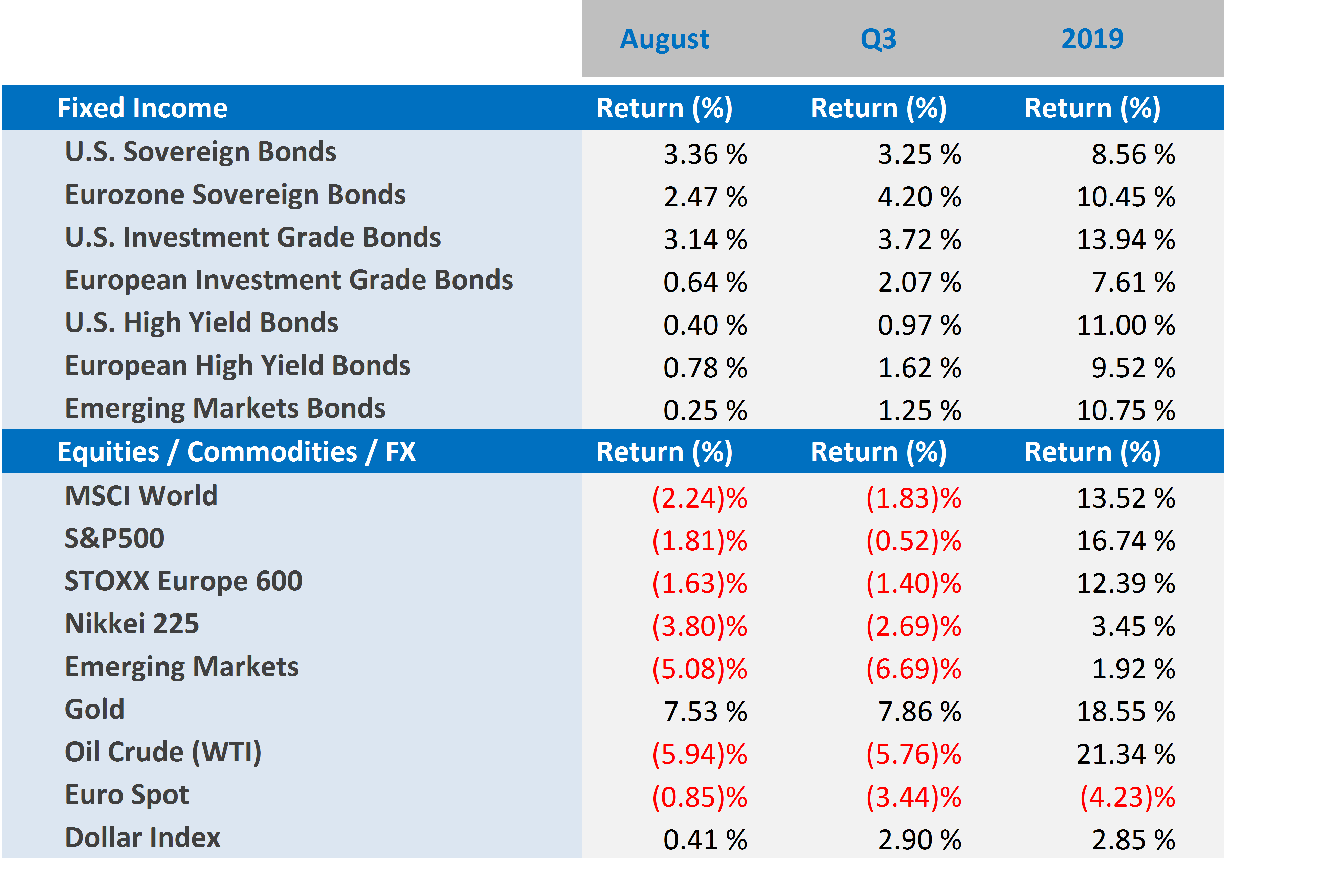

Markets had a rough ride and ended up with contrasting fortunes in the different asset classes. Equities suffered with the trade-war and economic related headlines, while fixed income and gold profited from increased risk aversion and uncertainties.

- Developed market equities had a negative month, as investors tried to digest the latest steps of the tango that became the trade war between China and the US. To add insult to injury, soft macroeconomic data from the US to Asia, as well as a yield curve inversion in the US (pointing to the heightened risk of a recession in the near future), kept investors on their toes and away from riskier assets. This was despite the respite given by central banks (including the Fed), which promised to promote economic growth in their respective regions. The S&P500 lost 1.81% in the United States and the STOXX Europe 600 fell by 1.63%, while in Japan, the Nikkei 225 plummeted 3.80%.

- Fixed income markets had a positive month across the board. Central banks showed their willingness to support economic growth by engaging in expansionary policies across the globe, pushing investors to flee equity markets for safer alternatives, such as long-term government bonds. US Treasuries jumped by 3.36%, the most since December 2008 (the height of the financial crisis), while US investment grade bonds soared 3.34% and US high yield bonds ended the month up 0.40%. In Europe, sovereign bonds gained 2.47%, investment grade bonds gained 0.64% and European high yield bonds gained 0.78%.

- Emerging markets had a mixed month, with small gains in bonds supported by lower yields in US Treasuries and losses in equities, as investors fled riskier assets in response to the threat of further escalation in the US-China trade war. EM equities lost 5.08%, while EM bonds gained 0.25%, despite strong losses in Argentina.

- Oil prices fell by 5.94% as investors tried to digest the recent escalation in the trade war between China and the US, as well as the yield curve inversion in the US, which points towards a recession becoming reality in the biggest economy in the planet.

- Gold had a strong month on the back of increased risk aversion by investors everywhere, climbing 7.53% to reach its highest level in 6 years. With uncertainty nowhere close to ending, we expect the yellow metal to continue to be strong as demand remains elevated.

Global markets in numbers

Market Outlook and V3´s position

The ‘preview’ to the movie has showed us that there is no easy way to deal with numerous uncertainties. Increasing geopolitical tensions, the impossible-to-solve trade war between China and the US, the Argentina crisis (which could spill over into other emerging economies), as well as the global economic slowdown (provoked not only by the US and Chinese tariffs, but also by the fact that the current economic expansion cycle has been running on fumes for a while), are all adding up to indicate there will be some explosive months to come, with roller coaster-like market performance becoming the norm, rather than the exception.

To try to give us a calm next few months, central banks are, once again, ready to react (or to act pre-emptively, in some cases) to bring some sense of normality to markets. Lowering interest rates from already historically low levels and engaging in quantitative easing policies (such as open market bond purchases), are some of the available tools that they will certainly tap into. However, the fact that we appear to be reaching the end of this economic expansion cycle (which started after the financial crisis of 2008) and that the fire power central banks have is much lower than at any other period in history, makes me question whether markets are prepared for the fast-paced action scenes that are likely to follow.

With a record 17 trillion dollars of negative yielding debt securities in the market and tight credit spreads for investment grade and higher rated high yield bonds, investors have almost no place to hide. The US yield curve inversion has become a self-fulfilling prophecy as investors chase anything remotely safe that is still positive yielding, such as long-term government bonds. The only way for this script not to end in a disaster is for central banks to take action to bring back investors’ confidence, who will in turn move markets higher. However, without a major shift in the economic expansion cycle, any additional up-turn will only give the can a short kick down the road, delaying the inevitable.

As a result, we are not anywhere near declaring the end of our defensive attitude to portfolio investing and are actively looking for opportunities to lower the overall portfolio risk, while still keeping some of the upside in case markets continue to stubbornly grind higher. Whether or not the movie will end up being an action-packed blockbuster, a melodramatic romantic comedy or a complete flop remains to be seen. Whatever it turns out to be, I am preparing my popcorn.

For more information, please contact our Chief Investment Officer, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com

Cover image: https://www.shutterstock.com/image-photo/picture-happy-friends-sitting-cinema-watch-693103291?src=-1-11